80 Maps

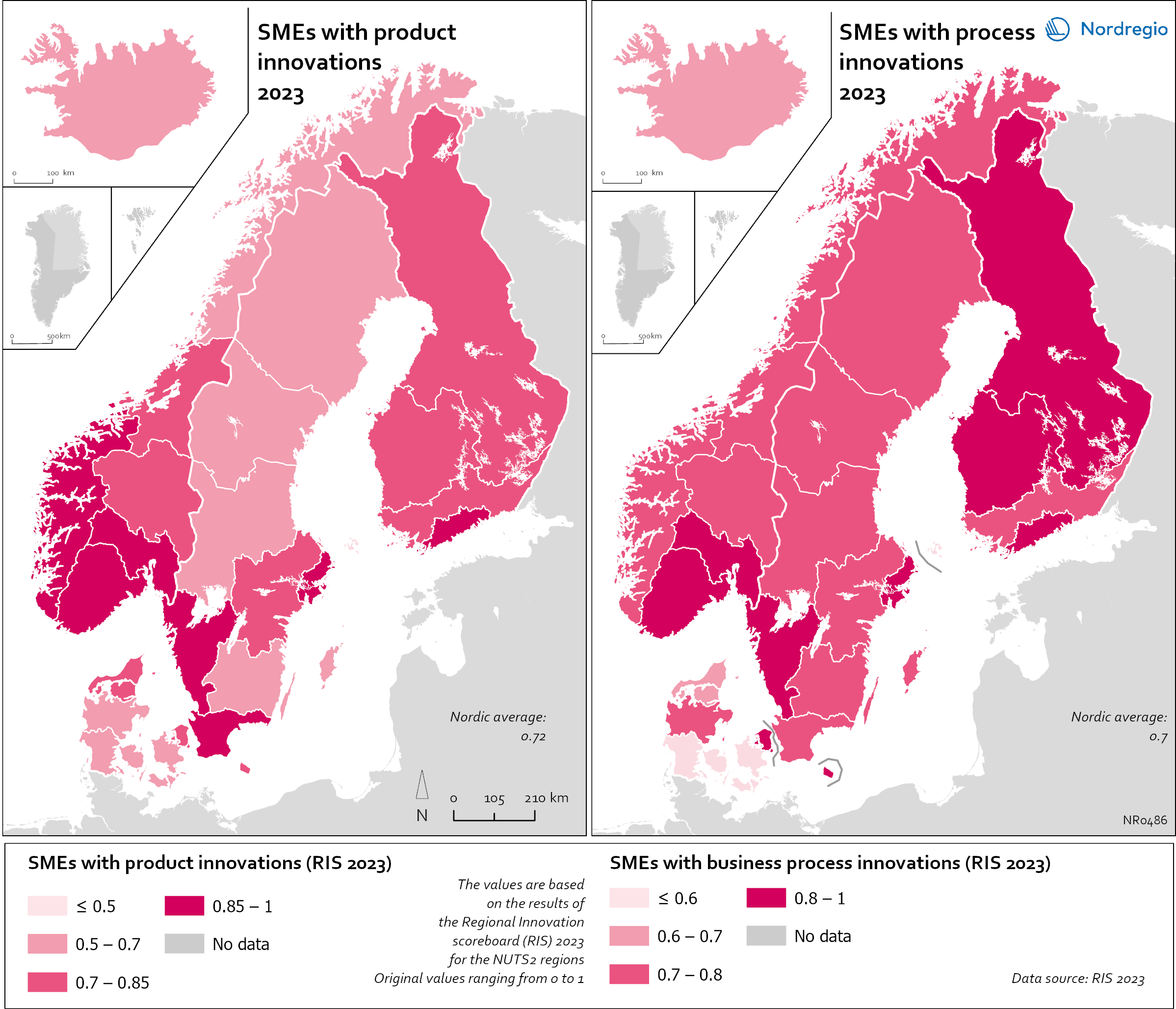

Small and Medium Sized Enterprises (SMEs) with product and business process innovation in 2023

These maps depicts Small and medium sized enterprises (SMEs) with product innovation (left map) and process innovation (right map) in 2023. The data is displayed at the NUTS2 level and the data comes from the Regional Innovation Scoreboard 2023. The left map depicts SMEs introducing product innovations as a percentage of SMEs in the Nordic regions, calculated as the share of SMEs who introduced at least one product innovation. The values for the map are normalised from 0–10. In this context, a product innovation is defined as the market introduction of a good or service that is new or significantly improved with respect to its capabilities, user-friendliness, components, or sub-systems. Rural regions tend to have lower levels of SMEs with product innovations, while urban regions have the highest levels. In 2023, Åland (0.235) had the lowest number of SMEs with product innovations in the Nordic Region, while Oslo had the highest (1.0). Etelä-Suomi and Stockholm regions were slightly behind, with 0.954 and 0.948, respectively. In Denmark, the leading regions were the Capital Region (Hovedstaden) and Northern Jutland (Nordjylland), with 0.719 and 0.715, respectively. Southern Denmark (Syddanmark) had the lowest level in Denmark, at 0.545. In Norway, the lowest value was in Northern Norway (Nord-Norge), 0.67, while in Sweden it was Middle Norrland (Mellersta Norrland), with 0.53. Taken as an average across the Nordic countries, Norway has a significantly higher number of SMEs with product innovations than the other countries. The right map shows the share of SMEs introducing at least one business-process innovation, which includes process, marketing, and organisational innovations. In general, Nordic SMEs are more likely to innovate in products rather than processes. The highest shares of process-innovating SMEs are found in most of the Finnish regions ranging from 0,79 in Länsi-Suomi to 0,91 in Etelä-Suomi, except of Åland…

2025 April

- Economy

- Nordic Region

- Research and innovation

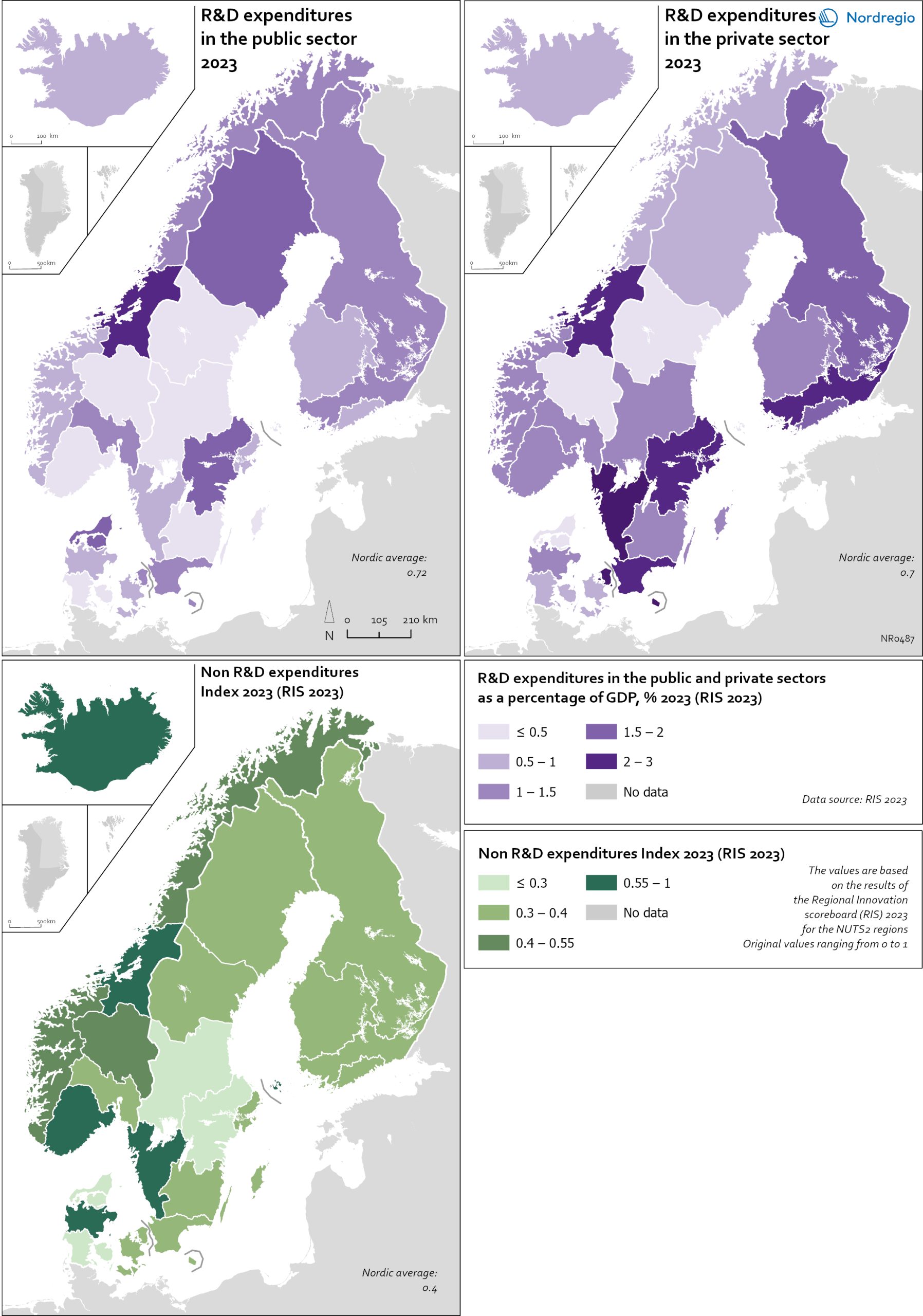

R&D and non-R&D expenditures in the public and private sector

These maps shows the expenditure on Research and Development (R&D) in the public and business sectors as a percentage of regional GDP, along with non-R&D innovation expenditure in Small and Medium Enterprises (SMEs) as a percentage of turnover. Together, these metrics offer a comprehensive understanding of the innovation landscape and provide insights into governments’ and higher education institutions’ commitment to foundational research, as well as the competitiveness and dynamism of the business environment and SMEs’ innovation capacity. By considering investment in both R&D and non-R&D activities, these indicators illustrate a broad spectrum of innovation drivers, from basic research to market-driven initiatives, and underscore the diverse pathways through which innovation fosters economic growth and social progress First, the top left map showcases R&D expenditure in the public sector as a percentage of GDP in the Nordic countries in 2023. In that year, the European level of R&D expenditure in the public sector, as a percentage of GDP, was 0.78%. By comparison, the Nordic average was 0.9%. While the more urban regions, in general, lead the Nordic regions, this is not always the case, as shown by the variation between the frontrunners. The leading region is Trøndelag (including Norway’s third-largest city, Trondheim), with 2.30% of regional GDP. It is in third place in the EU as a whole. The next regions are Övre Norrland with 1.77%, Northern Jutland with 1.54%, Östra Mellansverige with 1.52%, and Hovedstaden with 1.49%. A common feature of most of the top-ranking regions is that they host universities and other higher education institutions known for innovation practices. Most Nordic regions have not seen significant increases or decreases in public R&D spending between 2016 and 2023. The top right map focuses on the private sector’s investment in research and development activities and depicts R&D expenditure in the business sector…

2025 April

- Economy

- Nordic Region

- Research and innovation

Employment in high-skilled occupations 2022

This map displays the share of high-skilled workers as a share of the total number of workers in Nordic municipalities (big map) and regions (small map). “High-skilled workers” is here defined as group 1-3 (Managers, Professionals and Techinicians/associated professionals) of the International Standard Classification of Occupations (ISCO). For Iceland national data is used. The EU average of high-skilled workers is 43%, and the Nordic countries are at the top of the rankings – 49.5% in Finland, 51.1% in Denmark, 54.2% in Norway, 54.5% in Iceland and 58.9% in Sweden. On a regional level, the highest share is in the capitals and bigger cities, such as Stockholm (72%), Oslo (71%), Hovedstaden (Copenhagen) (60%), Uppsala (60%) and Uusima (Helsinki) (59%). The lowest shares are in the Finnish regions of EteläPohjanmaa, Keski-Pohjanmaa, Satakunta and Etelä-Savo (less than 40%). However, this does not necessarily mean that employers will have a greater chance of successfully recruiting high-skilled workers in the future, partly because those in this group already have jobs and partly due to generally lower investments in education.

2025 April

- Labour force

- Nordic Region

- Research and innovation

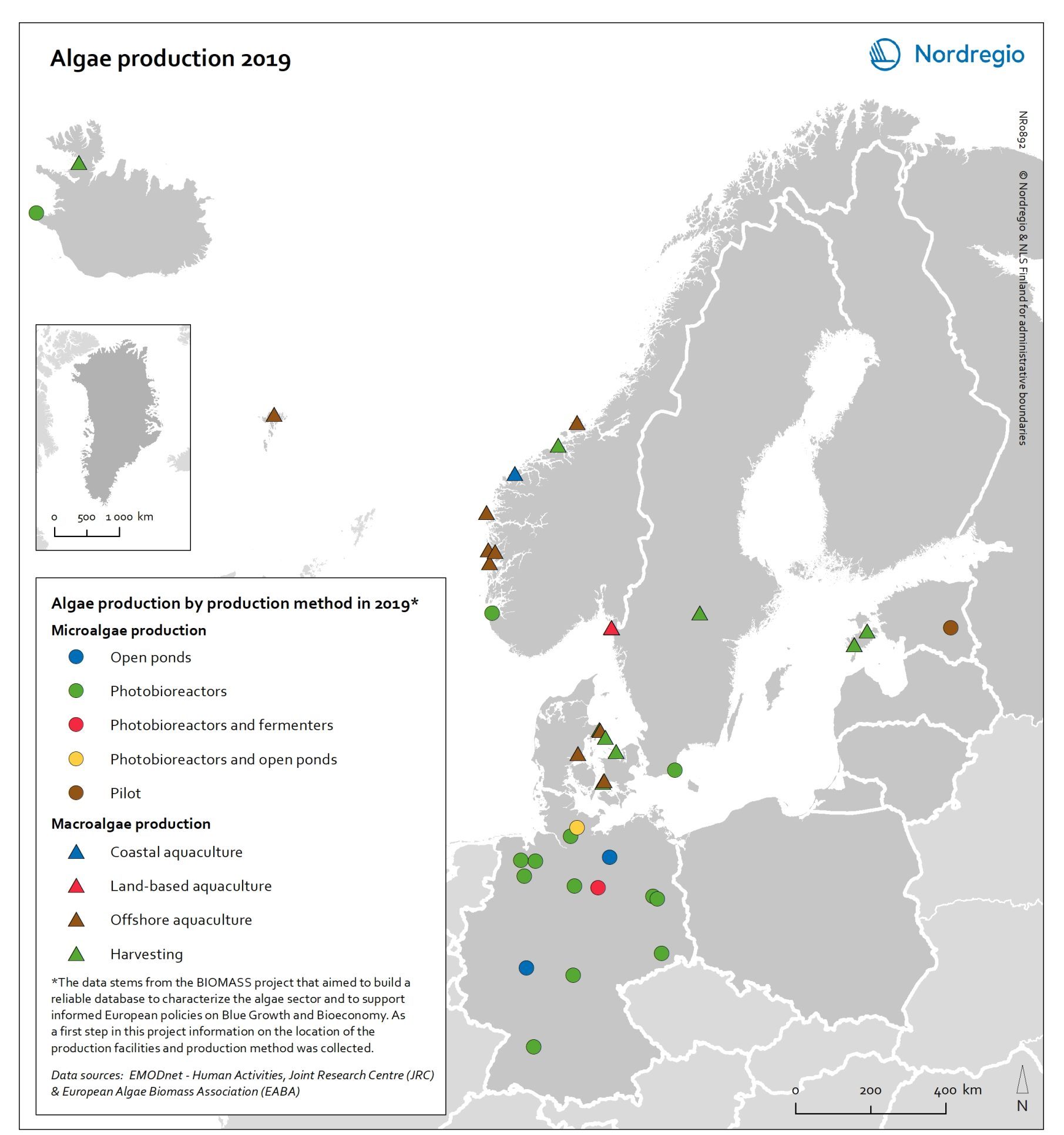

Algae production in 2019

This map shows location of algae production by production method in the Nordic Arctic and Baltic Sea Region in 2019 Algae and seaweeds are gaining attention as useful inputs for industries as diverse as energy and human food production. Aquatic vegetation – both in the seas and in freshwater – can grow at several times the pace of terrestrial plants, and the high natural oil content of some algae makes them ideal for producing a variety of products, from cosmetic oils to biofuels. At the same time, algae farming has added value in potential synergies with farming on land, as algae farms utilise nutrient run-off and reduce eutrophication. In addition, aquatic vegetation is a highly versatile feedstock. Algae and seaweed thrive in challenging and varied conditions and can be transformed into products ranging from fuel, feeds, fertiliser, and chemicals, to third-generation sugar and biomass. These benefits are the basis for seaweed and algae emerging as one of the most important bioeconomy trends in the Nordic Arctic and Baltic Sea region. The production of algae for food and industrial uses has hence significant potential, particularly in terms of environmental impact, but it is still at an early stage. The production of algae (both micro- and macroalgae) can take numerous forms, as shown by this map. At least nine different production methods were identified in the region covered in this analysis. A total of 41 production sites were operating in Denmark, Estonia, the Faroe Islands, Iceland, Norway, Germany, and Sweden. Germany has by far the most sites for microalgae production, whereas Denmark and Norway have the most macroalgae sites.

2021 December

- Arctic

- Baltic Sea Region

- Nordic Region

- Others

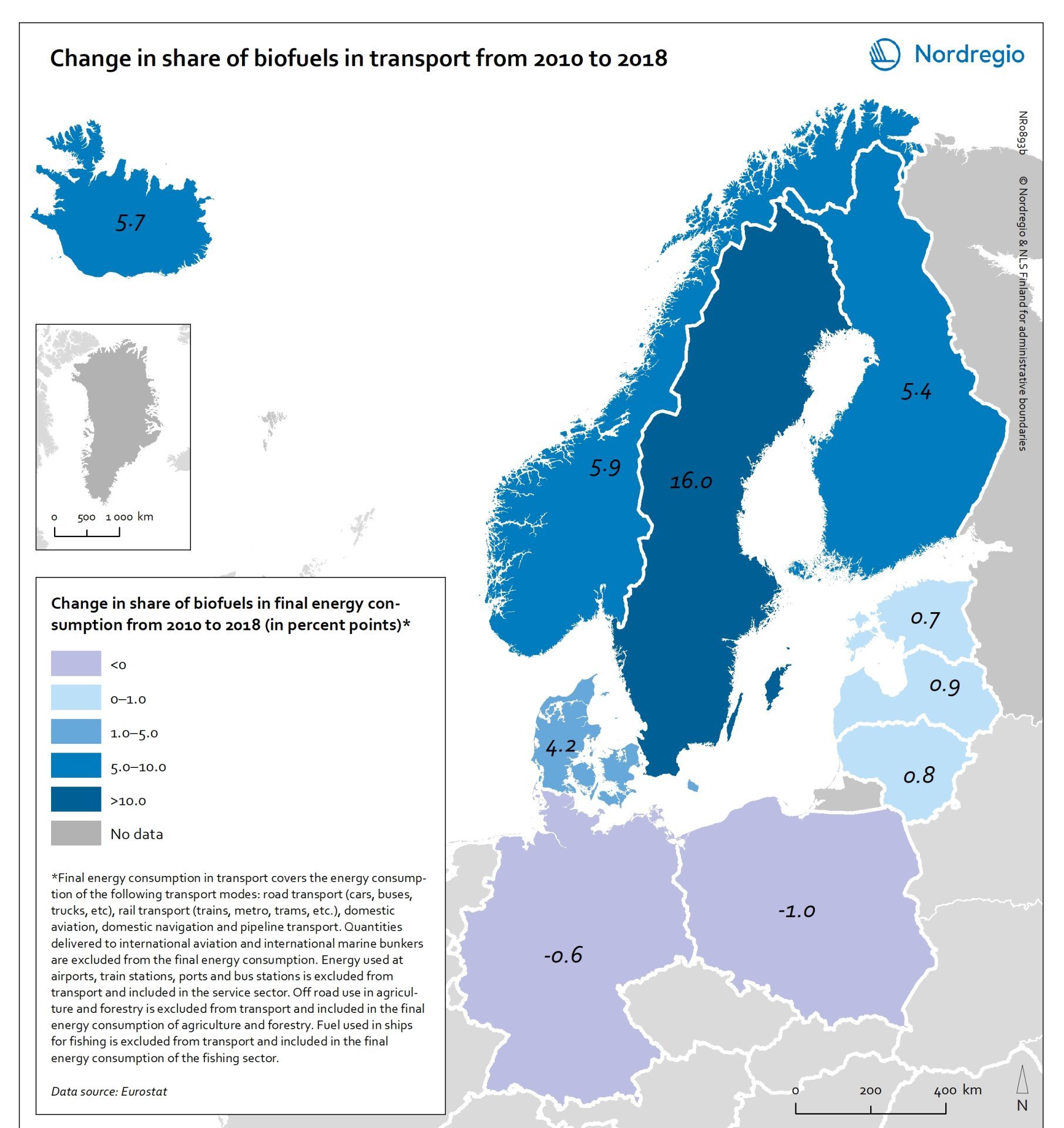

Change in share of biofuels in transport from 2010 to 2018

This map shows change in share of biofuels in final energy consumption in transport in the Nordic Arctic and Baltic Sea Region from 2010 to 2018. Even though a target for greater use of biofuels has been EU policy since the Renewable Energy and Fuel Quality Directives of 2009, development has been slow. The darker shades of blue on the map represent higher increase, and the lighter shades of blue reflect lower increase. The lilac color represent decrease. The Baltic Sea represents a divide in the region, with countries to the north and west experiencing growth in the use of biofuels for transport in recent years. Sweden stands out (16 per cent growth), while the other Nordic countries has experienced more modest increase. In the southern and eastern parts of the region, the use of biofuels for transport has largely stagnated. Total biofuel consumption for transport has risen more than the figure indicates due to an increase in transport use over the period.

2021 December

- Arctic

- Baltic Sea Region

- Nordic Region

- Transport

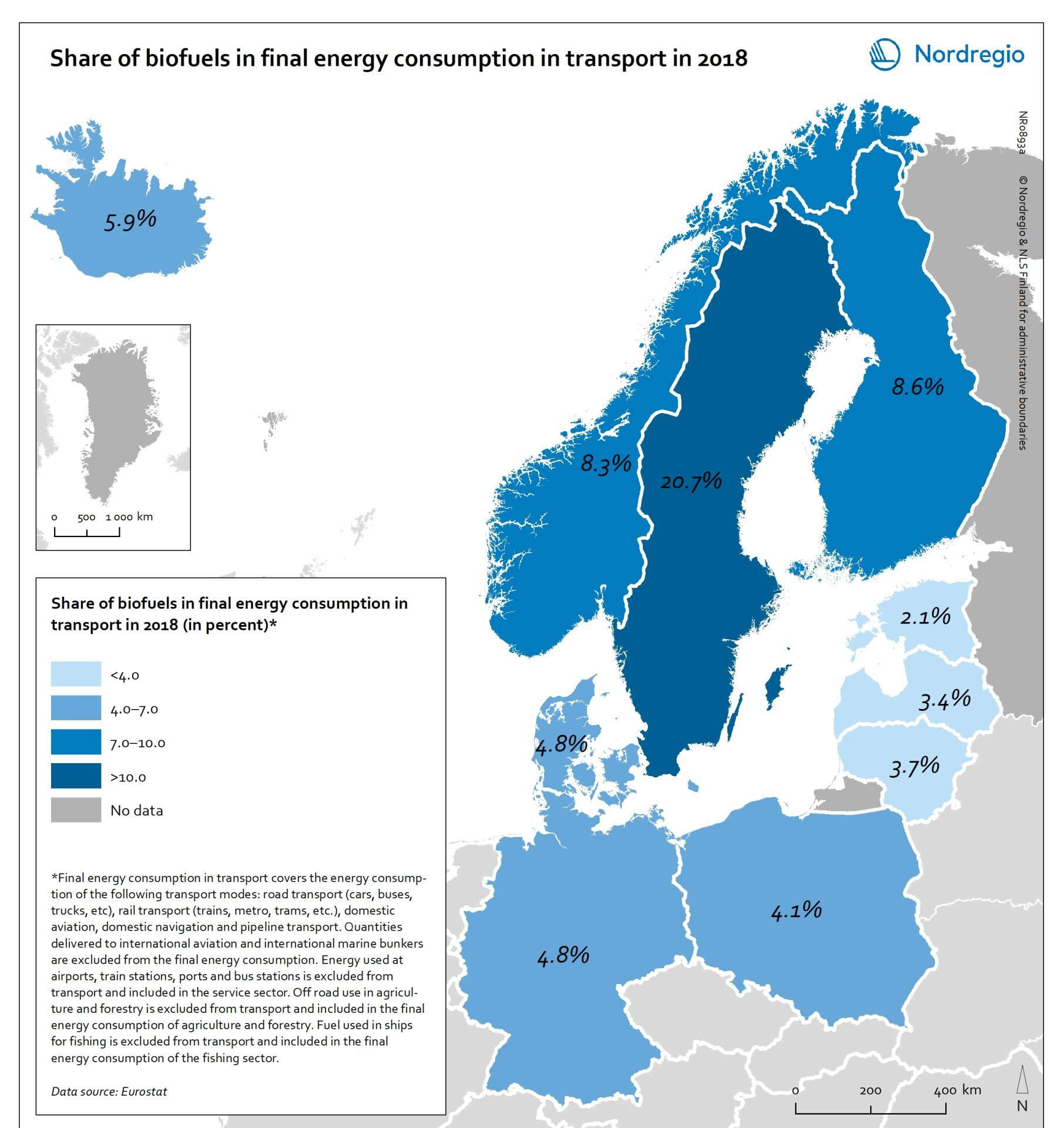

Share of biofuels in transport in 2018

This map shows the share of biofuels in final energy consumption in transport in the Nordic Arctic and Baltic Sea Region in 2018. There has been considerable political support for biofuels and in the EU, this debate has been driven by the aim of reducing dependency on imported fuels. For instance, 10 per cent of transport fuel should be produced from renewable sources. The darker shades on the map represent higher proportions, and the lighter shades reflect lower proportions. As presented by the map, only Sweden (20.7%) had reached the 10 per cent target in the Nordic Arctic and Baltic Region in 2018. Both Finland (8.3%) and Norway (8.3%) were close by the target, while the other countries in the region were still lagging behind, particularly the Baltic countries.

2021 December

- Arctic

- Baltic Sea Region

- Nordic Region

- Transport

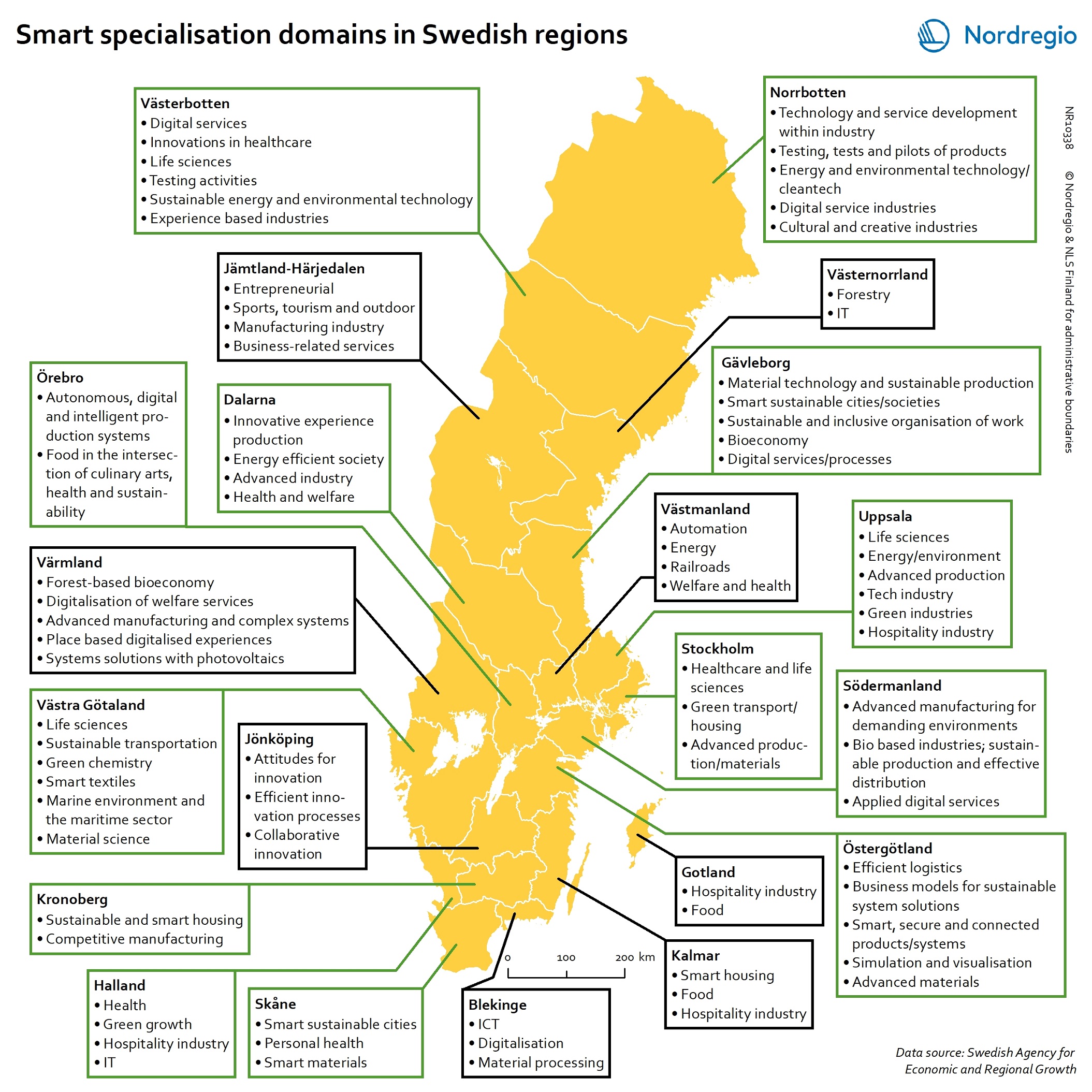

Smart specialisation domains in Swedish regions

This map gives an overview of the S3 focus areas in the Swedish regions in 2019. The major S3 domains in Sweden shown in the map provide a good overview of the key specialisation areas in Sweden. It is possible, for example, to check which Swedish regions have “green”, “sustainable”, “environment” at their smart specialisation domains (marked in green in their respective infoboxes for the domains in the figure). The information illustrated in the map can assist Swedish regions when they are considering opportunities for S3 synergy and co-operation with each other. In Sweden, the Swedish Agency for Economic and Regional Growth (Tillväxtverket) is a central actor in assisting regions in their work with smart specialisation. Tillväxtverket promotes opportunities for cooperation between the Swedish regional S3 processes and provides relevant information and learning seminars related to S3. Read the digital publication here.

2020 February

- Economy

- Research and innovation

- Sweden

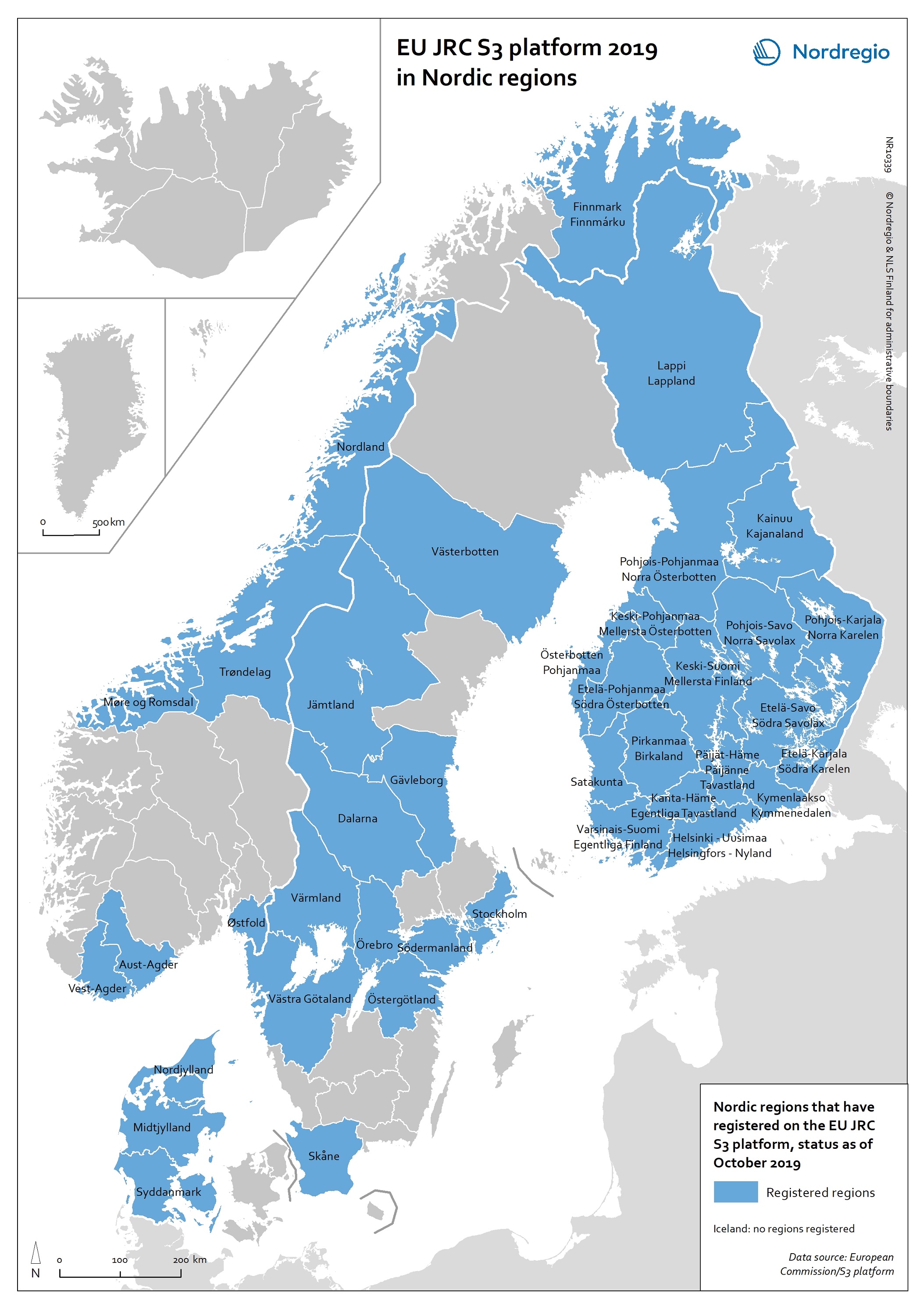

EU JRC S3 Platform 2019 in Nordic regions

This map shows the Nordic Regions that have registered on the EU JRC S3 platform, status as of October 2019. The regions that have registered on the S3 platform receive practical advice and broadened opportunities for international networking. In October 2019, there were 182 EU regions registered on the S3 platform, as well as 18 non-EU Member State regions. Of these regions, 38 are Nordic. It is worth noting that, as a non-EU member state, Norway has seven registered regions on the platform. Registration on the S3 platform is by no means a guarantee of success of a regional smart specialisation process, but it indicates the willingness of the region to learn more about S3 and to participate in international and interregional S3 cooperation through the possibilities provided by the S3 platform. The smart specialisation concept has been diffusing rapidly across Europe in the 2010s, as an increasing number of regions adopt it and design strategies departing from their own preconditions. The S3 platform in Seville, Spain, hosted by the Institute for Prospective Technological Studies (IPTS), was established in 2011 to assist EU countries and regions to develop, implement and review their smart specialisation strategies. The S3 platform provides information, methodologies, expertise and advice to national and regional policymakers, promotes mutual learning and transnational co-operation, and contributes to academic debates around the concept of smart specialisation. Read the digital publication here.

2020 February

- Economy

- Nordic Region

- Research and innovation

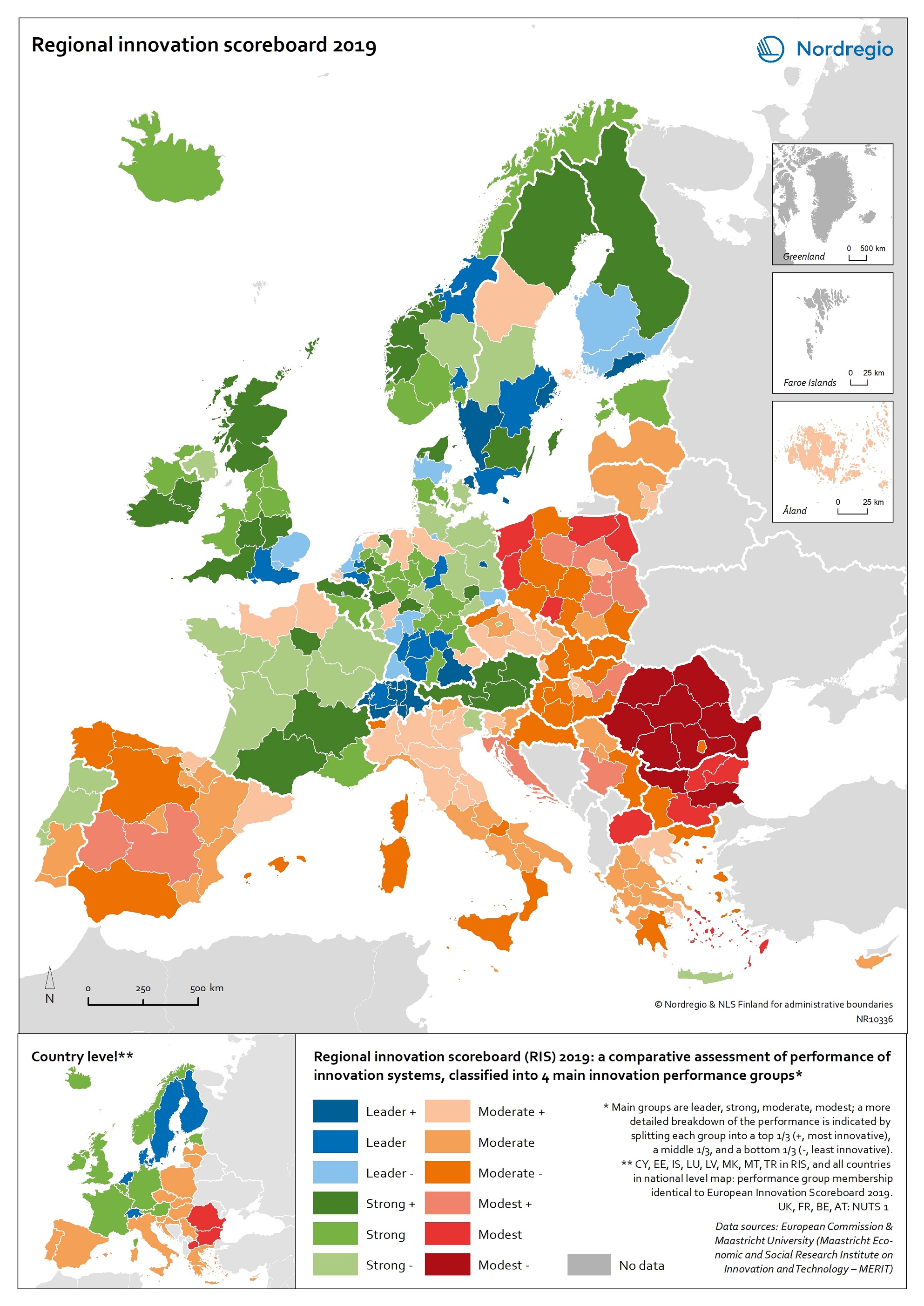

Regional innovation scoreboard 2019

This map shows the regional innovation scoreboard (RIS) in the European regions in 2019. The small map shows the innovation scoreboard at national level. The index shows the performance of innovation systems, classified into four main performance groups (leader, strong, moderate and modest). The European innovation scoreboard provides a comparative assessment of the research and innovation performance in European countries. It assesses the relative strengths and weaknesses of national innovation systems and helps countries identify areas they need to address. The Regional innovation scoreboard (RIS), a regional extension of the European innovation scoreboard, assesses the innovation performance of European regions on a limited number of indicators. The RIS 2019 covers 238 regions across 23 EU countries, as well as Norway, Serbia and Switzerland. Cyprus, Estonia, Latvia, Luxembourg and Malta are also included at country level. The RIS 2019 is a comparative assessment of regional innovation based on the European innovation scoreboard methodology, using 18 of the latter’s 27 indicators. It provides a more detailed breakdown of the performance groups with contextual data that can be used to analyse and compare structural economic, business and socio-demographic differences between regions. The Nordic regions are doing well in an overall RIS comparison regarding innovation performance. There are, however, considerable differences in innovation performance between the Nordic regions. For example, the capital regions have higher levels of innovation performance than more rural and peripheral regions, according to RIS 2019. This is often due to the critical mass of companies and the spatial significance of the proximity of firms and entrepreneurs, enabling knowledge-sharing and spill-over effects. Read the digital publication here.

2020 February

- Economy

- Europe

- Research and innovation

Higher educational institutions in the Arctic

The map shows universities and other educational institutions on post-secondary and tertiary level located in the Arctic. The red circles indicate a location of a university, college, or campus areas within the Arctic. The size of the circle corresponds to the number of educational institutions in a specific location. There is a high density of educational education institutions around Anchorage (Alaska), in Iceland, the Faroe Islands and the Arctic Fennoscandia (see zoom-in maps). In the Yukon (Canada), the Yukon College is the main educational institution, which has several campus areas across the region. In the Russian Arctic the largest centres with higher educational institutions are in Murmansk, Naryan-Mar (Nenets), Nizhnevartovsk (Khanty-Mansi), Salekhard (Yamalo-Nenets), and Yakutsk (Sakha).

2019 March

- Arctic

- Others

- Research and innovation

Natural population change in the Arctic

The map shows the annual natural population change rates in the Arctic subregions between 2013 and 2017. The blue tones indicate a positive change: subregions where the number of live births exceeds the number of deaths. The yellow colour indicates no or little change: subregions where the difference between births and deaths are close to zero. The red tones indicate negative change: subregions where the number of deaths exceed the number of live births. In the Artic the annual average natural population change rate was 0,66% between 2013 and 2017. The natural population change was positive especially in the Canadian Arctic, Alaska (USA), Greenland as well as in Yamalo-Nenets, Khanty-Mansi and in Sakha regions (Russian Federation). Natural population decline was the strongest in the Nordic Arctic, as well as in Murmansk, Magadan, and Kamchatka (Russian Federation).

2019 March

- Arctic

- Demography

Tertiary educational attainment level in the Arctic

The map shows the percent of individuals aged 25-64 with tertiary education as the highest attainment level in the Arctic regions in 2017. Tertiary education corresponds to International Standard Classification of Education (ISCED) 2011 levels 5-8, which represent bachelor or equivalent and all higher attainment levels. The dark green tones show regions where more than 30% of individuals attained tertiary education as highest level. The light green tones show regions where less than 15% of individuals attained tertiary education as highest level. Highest shares of working aged population with tertiary education were found in Troms (Norway, 43,8%) and Iceland (42,5%). All other Nordic Arctic regions as well as Yukon (Canada, 33,3%) and in some regions in Alaska (USA) had high shares of highly educated people. Northern Quebec (Canada) had the lowest share of working aged population that attained tertiary education (13,0%).

2019 March

- Arctic

- Demography

- Economy

Upper secondary educational attainment level in the Arctic

The map shows the percent of individuals aged 25-64 with upper secondary education as highest level attained in 2017 in Arctic regions. The upper secondary education corresponds to International Standard Classification of Education (ISCED) 2011 levels 3-4. The dark blue tones show regions where more than 80% of individuals attained upper secondary education as highest level. The lightest blue tones show regions where less than 60% of individuals attained upper secondary education as highest level. Among the working age population, the number of individuals with upper secondary education was the highest in Alaska (USA, over 90%). Individuals with upper secondary education attainment level was also high – above 80% – in the Yukon and Labrador (Canada), Norrbotten (Sweden), and in Lappi (Finland). The lowest share of individual with upper secondary education was in Greenland (45,6%), Chukotka (Russian Federation, 58,4%) and in Nunavut (Canada, 59,1%).

2019 March

- Arctic

- Demography

Labour force participation rate in the Arctic

The map shows the regional labour force (active population) as share of total population in the Arctic regions in 2016. The active population includes all persons (aged 15 years old and over) with at least one current paid job or searching for one. The dark green tones show regions with high participation rates and correspondingly light green tones show regions with low participation rates. The Russian Arctic regions of Chukotka (83,6%), Yamalo-Nenets (78,0%), and Magadan (76,1%) had the highest participation rates. The lowest participation rates were in Lappi (Finland, 53,3%) and in Nordland (Norway, 59,9%).

2019 March

- Arctic

- Economy

- Labour force

Unemployment rate in the Arctic

The map shows unemployed persons as share of the labour force (aged 15 years old and over) in the Arctic regions in 2016. The dark orange tones show regions with high unemployment rates and correspondingly light orange tones show regions with low unemployment rate. Nunavut and Newfoundland and Labrador (Canada, 14,0% and 13,4%, respectively) had the highest unemployment rates. The unemployment rate was the lowest in Finnmark, Nordland, and Troms (Norway, 2,6%, 3,3%, and 3,3%, respectively), in the Faroe Islands (3,3%), in Iceland (3,0%), as well as in three Russian Arctic regions: Magadan (3,1%), Yamalo-Nenets (3,1%), and Chukotka (3,2%). The unemployment rate in the Arctic regions mostly follows the national averages.

2019 March

- Arctic

- Economy

- Labour force

Part-time employment incidence in the Arctic

The map shows the share of the part-time employees over total employment in the Arctic regions in 2014. Part-time workers are considered as persons (aged 15 years old and over) who are working less than 30 hours per week. The dark blue tones show regions with high part-time employment incidence and correspondingly light blue tones show regions with low part-time employment incidence. The three Arctic regions of Norway had the highest part-time employment incidence: Nordland (59,5%), Troms (56,3%), and Finnmark (56,0%). The Russian Arctic regions of Yamalo-Nenets (0,9%), Khanty-Mansi (2,5%), and Chukotka (3,4%) had the lowest part-time employment incidence.

2019 March

- Arctic

- Economy

- Labour force

Employment rate in the Arctic

The map shows the employment rate for the Arctic regions in 2016 based on OECD data. The employment rate is the ratio between the employed population and the working age population (aged 15 years old and over). Employed persons are aged 15 or over who report that they have worked in gainful employment for at least one hour in the previous week or who had a job but were absent from work during the reference week. The dark blue tones show regions with high employment rates and correspondingly light blue tones show regions with low employment rate. The highest employment rates in the Arctic regions were in the Faroe Islands, Svalbard, the Yukon (Canada), Chukotka, Yamalo-Nenets, and Magadan Oblast (Russian Federation). The lowest employment rates were in Finnish Lapland (48,1%), Newfoundland & Labrador, and Nunavut (Canada, 52,4% and 53,0%, respectively). The employment rate in the Nordic Arctic regions was lower than the average of their respective countries whereas in Alaska (USA) and the Russian Arctic the employment rate was higher than average of their respective countries.

2019 March

- Arctic

- Economy

- Labour force

Population change in Arctic settlements

The map provides an overview of the population change in Arctic settlements with 500 inhabitants or more during the period 2000 to 2017. The purple underlaying layer shows the extent of permafrost across the Arctic. The circles indicate settlements with 500 inhabitants or more and are proportional to the total population in 2017. Blue tones indicate population growth between 2000 and 2017, while red tones indicate population decline. Four zoomed-in maps show areas with high settlement density – Arctic Fennoscandia, Iceland, the Faroe Islands, and Alaska. In Alaska, population increased in the largest settlements between 2000 and 2017. The population decline in small settlements located far from the two large cities – Anchorage and Fairbanks – has been caused by outmigration, which has cancelled out the positive natural population growth. In the Canadian Arctic, most people live in a few settlements. Similar to Alaska, the population increased in the largest settlements and decreased in small settlements. Most of the smaller settlements in Arctic Fennoscandia have witnessed a population decline between 2000 and 2017, except in Norway. The dominant pattern in Fennoscandia is a population growth in larger settlements and a population decline in surrounding smaller settlements. This is similar to the pattern observed in the other Nordic Arctic countries – Iceland, Greenland, and the Faroe Islands. New inhabitants settled in the capitals (Reykjavik, Nuuk, and Torshavn) and regional centres, from both domestic and international locations, while settlements in sparsely populated areas are becoming less attractive to incomers. In the Russian Arctic, the regions can be divided into the oil and gas areas of the Khanty-Mansi and Yamal-Nenets, and other areas. The population is growing in the oil and gas areas and declining slowly in the others. Over 75% of the settlements have been shrinking throughout the 21st century, mainly because…

2019 March

- Arctic

- Demography

- Migration

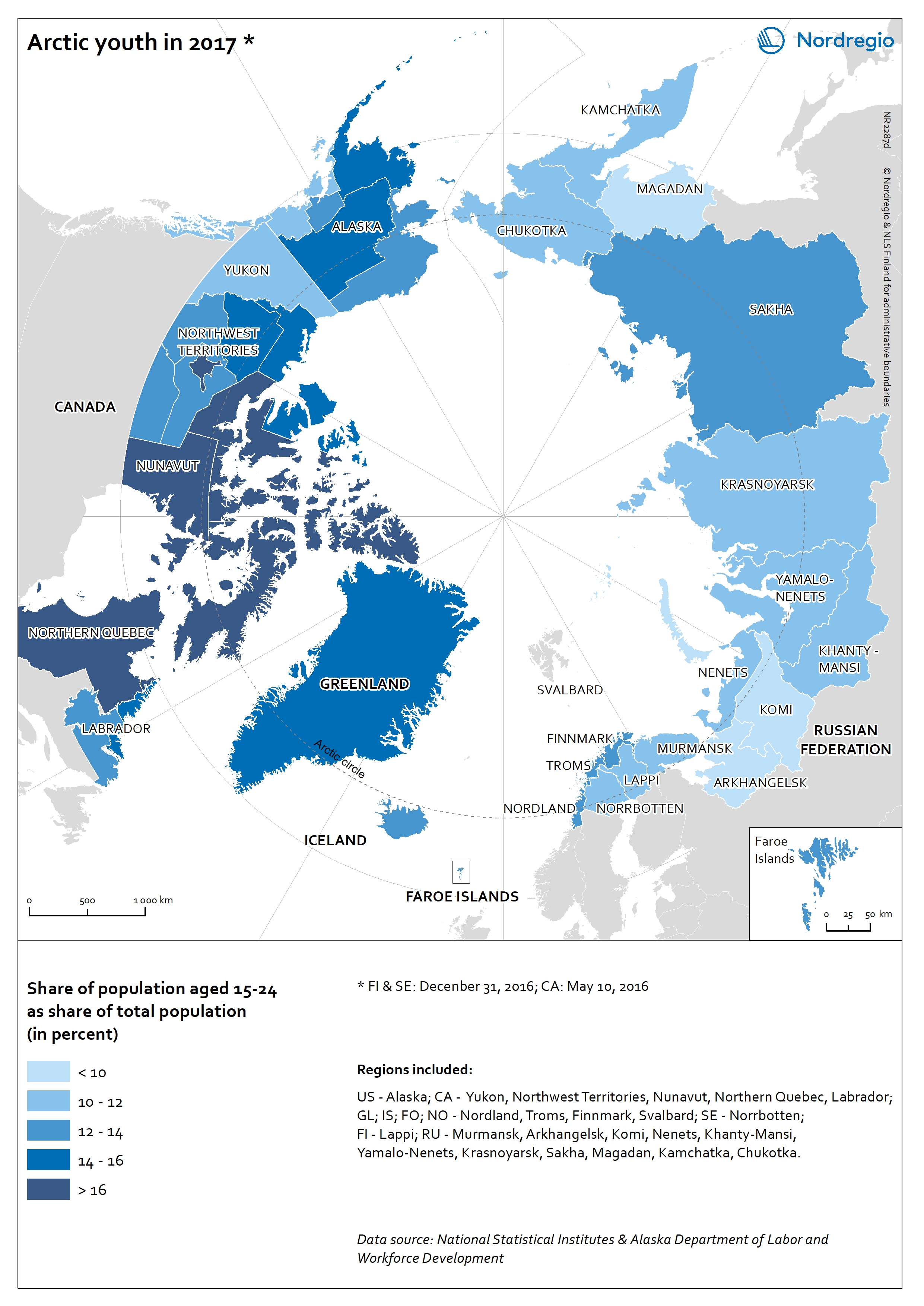

Share of youth population in the Arctic

The map shows the population aged 15-24 as share of the total population in 2017 at the regional level in the Arctic. Age 15 to 24 is a standard international definition of youth used by the OECD and United Nations. Dark blue tones indicate regions with high share of youth in the total population, and light blue tones indicate regions with low share of youth. Keewatin in Nunavut region (Canada) had the highest share of youth (18,8%). Region 3 in the Northwest Territories, Northern Quebec, as well as the other two regions in Nunavut (Canada) had a share of youth above 15%. Magadan (9,2%), Arkhangelsk (9,4%) and Komi (9,7%) (Russian Federation) had the lowest shares of youth in their total populations.

2019 March

- Arctic

- Demography

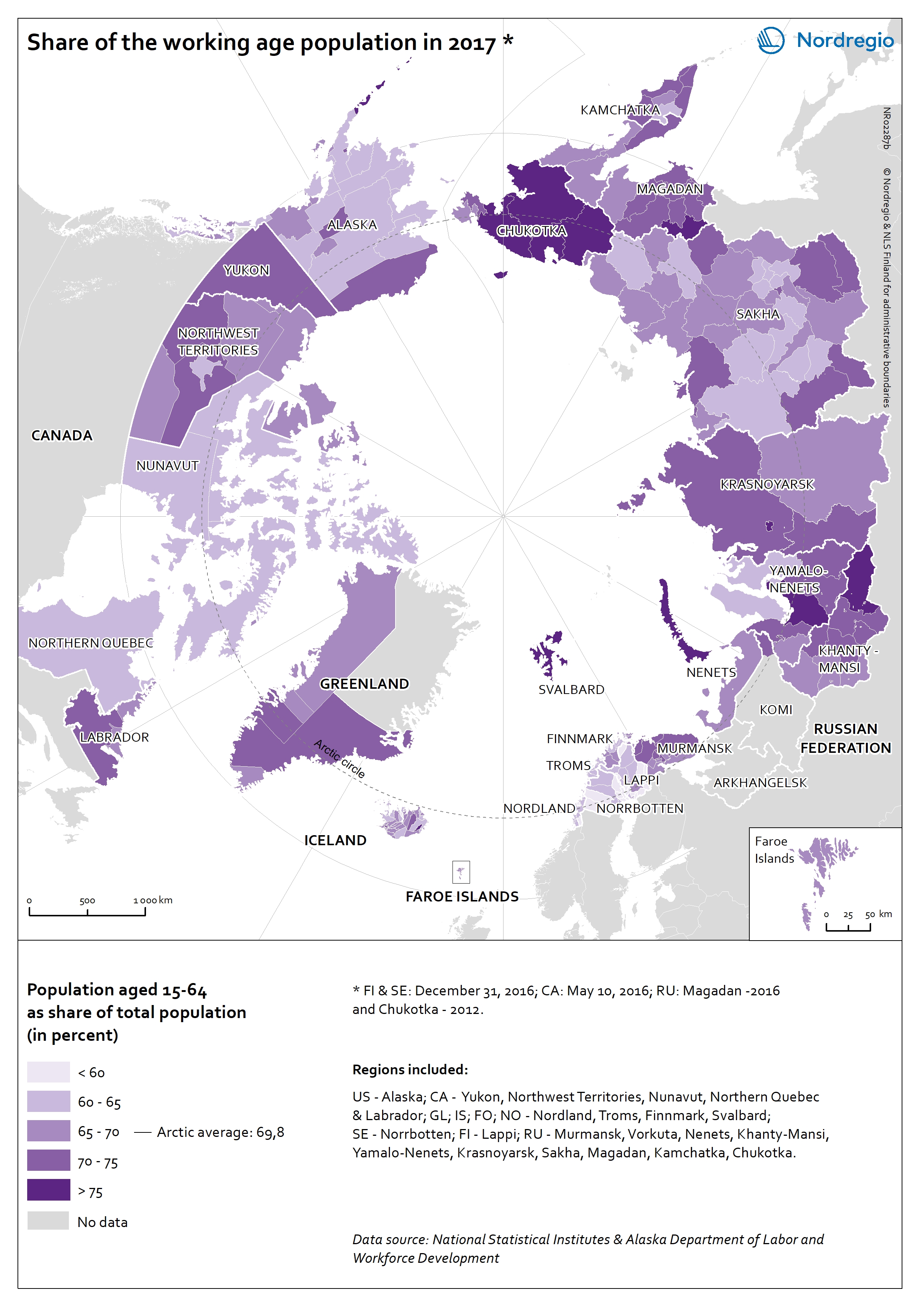

Share of working age population in the Arctic

The map shows the population aged 15-64 as a share of the total population in 2017 at the sub-regional level in the Arctic. Dark purple tones indicate subregions with high share of working age population, and light purple tones indicate subregions with low share of working age population. In the Arctic the share of the working age population was 69,8%. The highest share of working age population was in regions where a large share of employment is related to natural resources extraction such as oil, gas, and minerals. This is especially the case in the Russian Arctic regions. All subregions in the Nordic countries had a share of working age population smaller than 60%. Subregions in the Russian Federation as well as in Svalbard (Norway) and in Aleutian Islands (Alaska) had high shares of working age population.

2019 March

- Arctic

- Demography